Secure Payment Methods for your Online Store

Basically, it depends on many factors whether an online store is operated successfully or hardly achieves any sales. An urgent role is played by the selection of the right payment methods.

For a successful online store, diverse and trustworthy payment methods are crucial. The most important ones include credit cards, PayPal, Klarna, direct debit, prepayment and purchase on account. Each method has its advantages and disadvantages, both for the customer and for the store operator.

After all, consumers must be able to rely on being able to pay for their purchases in your online store conveniently and via trustworthy payment processors. Those who offer their customers suitable payment options usually achieve more sales.

You use WordPress and want to start a WooCommerce store? Then you can jump right here to my recommendation.

Overview: Choosing the right payment methods

If you have an online store, then an essential part of your business model is to provide your customers with the right payment methods, so they can fund their purchases with payment options they are familiar with. Therefore, it is of great importance that you offer a wide range of payment methods so that you can appeal to the largest possible number of potential customers.

Table: Overview of payment systems for online shops

| Payment method | Advantages | Disadvantages | Fees & efficiency | Recommendation |

|---|---|---|---|---|

| Credit card | Universally accepted, convenient, secure | Some customers do not have a credit card | Varies by provider, often 2-3 | Indispensable in every online shop |

| PayPal | Fast, secure, high number of users | Fees for the merchant | About 1,9 % € 0,35 per sale | Highly recommended, especially for international sales |

| Klarna | Allows installment payments, instant payout to merchant | Setup and integration can be complex | Varies, often higher than other methods | Interesting for higher priced items |

| Mollie | Versatile, easy integration, fast payouts | Fees can vary, less known | About 1.1% € 0.25 per transaction | Recommended as a versatile solution |

| Stripe | Easy integration, low fees, fast transactions | Less known in some markets | 1.4 % € 0.25 for European cards | Especially suitable for developers and scalable projects |

This post can serve as a guide for you to make an informed decision about payment methods in your online store.

Credit card payments

- Advantages: Universally accepted, convenient, secure

- Disadvantages: Some customers do not have a credit card

- Recommendation: Indispensable in every online shop

Currently, it is impossible to imagine life without credit card payments. More and more people use credit cards as a payment method. This is because it is much easier to take a credit card with you than to carry around a lot of cash.

In addition to this, there is greater security than when carrying cash, as cash can be stolen. Although the card can also be stolen or lost, it can only be used if the PIN is known. In addition, the credit card can be blocked by the issuing bank after it has been lost.

Accordingly, the credit card is a widespread means of payment that is appreciated by consumers for its high security and convenience. You should therefore definitely offer credit cards as a payment method in your online store.

Included here are Visa, Mastercard, Giropay, Debit Card, Charge Card and Prepaid Card.

Almost all the following providers come with CC support.

PayPal – US payment giant as industry standard

- Advantages: fast, secure and high number of users

- Disadvantages: Fees for the merchant

- Recommendation: Highly recommended, especially for international sales

According to Statista, there are currently a total of about 431 million active accounts with PayPal. Especially for online orders, buyers often rely on PayPal as a payment service provider to purchase goods. An account with PayPal allows customers to complete their purchases quickly and easily.

This is because with PayPal, it is not necessary to re-enter credit card details for every single purchase.

In addition to this, PayPal offers buyer protection. So if buyers get the wrong or defective goods sent to them, then it is possible to get the cost of the purchase refunded by PayPal.

Customers therefore benefit from less hassle and greater security, while online store owners can look forward to a higher conversion rate. Accordingly, PayPal is one of the payment methods you should definitely offer in your online store.

The PayPal fee calculator

The PayPal fee calculator is a handy tool that allows you to calculate in advance the costs that are incurred during transactions. This means that the PayPal Fee Calculator enables you to precisely calculate the fees for different sales prices. The prices of your goods can thus be optimally adjusted and you get a clear idea of how high your profits will be.

How it works

The PayPal fee calculator works simple and with few inputs. First of all, you have to enter the selling price of a product. Then you choose in which country the product should be sold. In the last step, you have to enter the type of sale, i.e. whether it is goods or services. The PayPal fee calculator will then determine the applicable fees. With this, you can estimate exactly how the fees will affect your margins.

Klarna

- Advantages: Allows for installment payments, immediate payout to merchant

- Cons: Setup and integration can be complex

- Recommendation: Interesting for higher priced items

Klarna is an established payment service provider that originates from Sweden and has been in the market since 2005. This provider is primarily known for allowing customers to pay off their purchases in installments. This allows customers to spend more money on purchases, from which online store owners benefit accordingly.

If you install the Klarna plug-in in your online store, then the customer will already be shown on the product page how much they will have to pay for the item each month. This makes the item appear cheaper and increases the likelihood that the buyer will decide to place an order.

A big advantage for you as a merchant is that Klarna pays you the money immediately. You do not have to wait for the customer to arrange the payment. Thus, Klarna is also one of the payment methods that belong in every online store.

Klarna also includes Sofort or Sofortüberweisung, which is very popular in Germany and Austria.

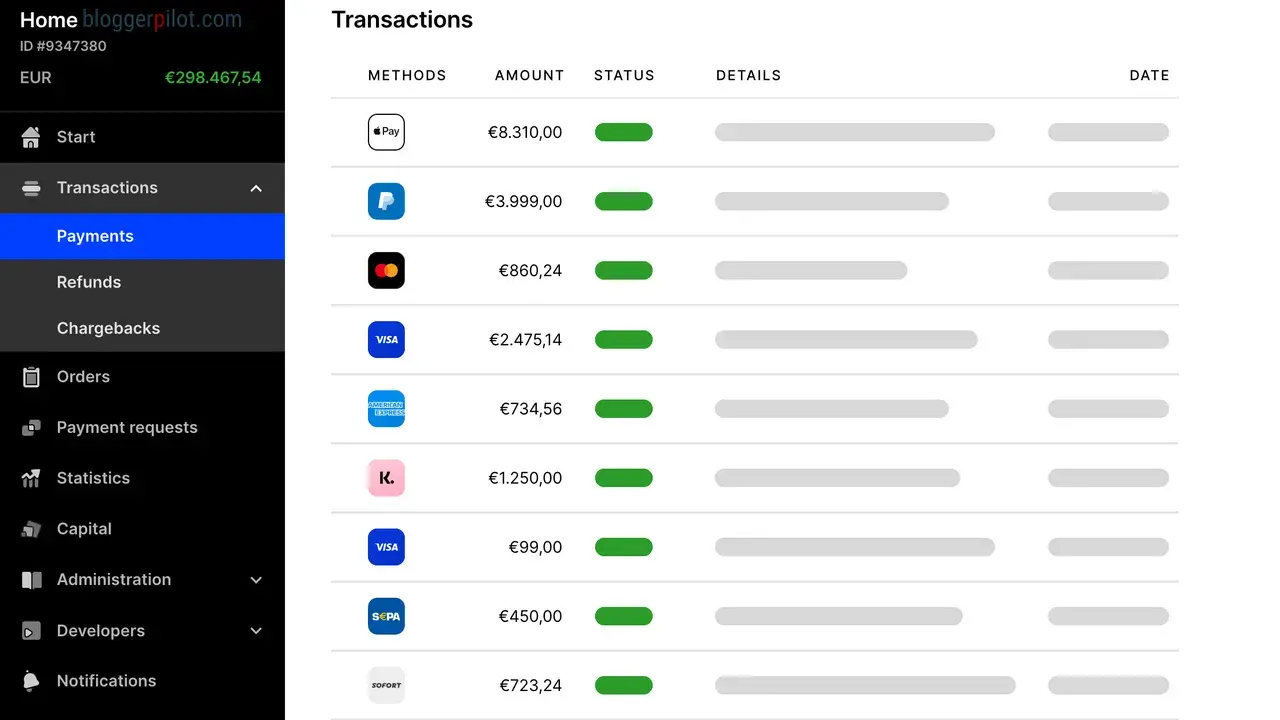

Mollie

- Pros: Versatile with support for multiple payment methods, easy integration, fast payouts

- Disadvantages: Fees can vary, less well-known than PayPal or Klarna

- Recommendation: Recommended as a versatile solution, especially for stores that want to offer multiple payment options

Mollie is a payment platform that allows merchants to easily integrate multiple payment options into their online stores. The user-friendliness of the platform, which applies to both store owners and end customers, is particularly noteworthy.

With Mollie, you can offer a variety of payment methods such as credit card, PayPal and regional options like iDEAL or SOFORT Banking. This flexibility makes Mollie an attractive choice for online stores that want to appeal to a wide audience.

Especially for smaller clients, I use Mollie more often in conjunction with WooCommerce. The setup is simple and quickly done. The use for the store owner just the same.

They have a well-maintained WordPress plugin that lets you hit the ground running.

Stripe

- Pros: High flexibility, support for many currencies and payment types, strong security features

- Disadvantages: Fees can be higher for smaller stores, requires technical expertise for customization

- Recommendation: particularly suitable for growing or internationally focused online stores looking for a scalable and customizable solution.

Stripe is a widely used payment gateway solution that enables businesses to seamlessly process online payments. The platform supports a wide range of payment methods, including credit cards, debit cards and digital wallets like Apple Pay.

A key feature of Stripe is its adaptability: developers can scale and customize the platform as needed, making it particularly suitable for growing startups and established businesses.

Stripe also offers a range of additional services such as subscription billing, fraud prevention, and financial reporting.

Direct Debit – SEPA

- Advantages: Simple and popular with customers

- Disadvantages: Risk of non-payment

- Recommendation: Recommended, but should be used with caution

Direct debit is one of the most popular payment methods among customers. The process of using this payment method is simple. During the payment process, the customer enters his or her account details, thus giving the merchant permission to collect the money from his or her bank account. The amount is not debited immediately, but at a later time.

As an online store operator, you have the option of either handling the process yourself or using the services of a payment service provider. In case a payment processor is hired, the money is automatically deducted from the customer’s account and credited to your account. Buyers appreciate this payment method because it is convenient.

However, a disadvantage for merchants is that the customer may not even have the required amount in the account. In such a case, the money would be deducted only a few days later. The goods have then probably already been shipped and there is a risk of non-payment.

Nevertheless, it is recommended to integrate this payment method in the online store because it is in high demand from customers. If you want to be on the safe side, direct debit can also be processed via a payment provider. However, fees will be charged for this.

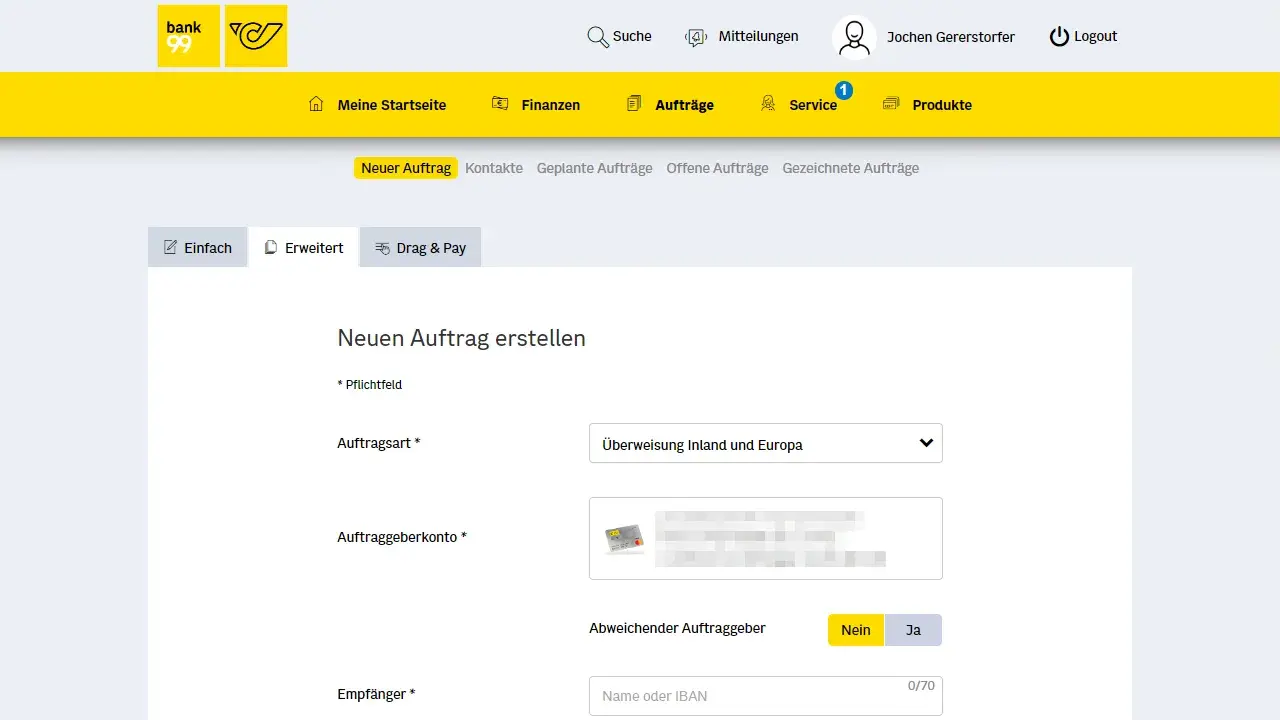

Prepayment

- Advantages: No fees, low risk for the merchant

- Disadvantages: Long processing time, lower conversion rate

- Recommendation: As a supplement to other methods

The so-called prepayment is one of the simplest payment methods that an online store can offer. The customer only needs to know your bank account details. The process is also kept simple for the buyer.

He only needs access to online banking and can easily pay for the transaction via his bank. A big advantage of this payment method is that there are no additional costs. External payment service providers always charge a fee for processing transactions, which is not the case here.

Payment in advance is therefore correspondingly favorable for online store operators. In addition to this, the goods are not shipped until the customer’s payment has already been made. In concrete terms, this means that the payment cannot bounce afterward unless the customer exercises their right of withdrawal and returns the goods. After all, in this case the customer is paying in advance, so you can be sure that he has enough money.

However, this payment option also has a few disadvantages:

- High processing time: it usually takes 2-3 days for the money to arrive at the online retailer and for the goods to be shipped out

- Leap of faith: The merchant might not ship the goods despite payment

- Change of mind: The customer either forgets to pay or decides not to pay after all

This means that prepayment is not the most popular payment method among customers. You should therefore see the advance payment rather as a supplement to other payment options.

Purchase on account

- Pros: very popular, no cancellations in the ordering process

- Disadvantages: Risk lies with the merchant

- Recommendation: With caution and possibly via a payment service provider

Purchase on account is one of the most popular payment methods in online stores. This is hardly surprising when you consider that buyers do not have to make any advance payments. They receive the goods immediately and do not have to pay for them until later.

Technically, the purchase on account can be implemented in the same way as the purchase in advance. In concrete terms, this means that the buyer must transfer money to the account of the online store. Only the timing of the transfer differs. Since the customer does not have to pay for the goods until they have received them, there is no need to enter any details in the payment process.

There are several advantages for customers:

- No need to provide sensitive bank details during the ordering process

- No financial loss if the goods are not delivered after all

- If the goods are returned to the merchant because the customer does not like them, there is no need to transfer the purchase price back to the merchant

If you offer this payment method in your online store, however, there is a serious disadvantage. The risk is entirely yours. If the customer does not pay for the shipped goods, it will be difficult to get the purchase price back. On the other hand, the advantage is that the cancellation rate during the ordering process is low. If you are worried about the increased risk of non-payment, then there is an option to assign the receivables to a payment processor.

Amazon Pay, Google Pay, Apple Pay and Alipay

Choosing the appropriate payment methods should consider both the needs of your target customers and the technical and security requirements of your own online store.

- Amazon Pay allows users to make purchases using payment data from their Amazon account, which speeds up the payment process and increases customer satisfaction.

- Google Pay relies on the widely used Google account and enables fast, contactless payments both online and offline.

- Apple Pay, tightly integrated into the Apple product ecosystem, provides a seamless and secure payment option for iOS users and is highly regarded for its security features.

- Alipay, particularly popular in China, offers a variety of payment options including QR codes and has established itself as a must-have payment system in several international markets.

In the German-speaking market, Amazon Pay has the greatest relevance. This certainly accommodates some potential customers.

Which of these payment methods do you think could integrate particularly well into your online store’s offering? And what criteria are most important to you when choosing a payment service?

Cryptocurrencies

A new trend in the e-commerce world is the acceptance of cryptocurrencies like Bitcoin. This payment method is usually fee-free for the merchant, as transaction costs are usually borne by the buyer. In addition, cryptocurrencies can be used internationally, which makes them particularly attractive.

However, note the volatile rates and possible tax implications.

Fees and economics

Choosing the right payment methods and store CMS not only affects the user experience, but also the profitability of your online store. Here are some considerations for the costs associated with different payment services and store systems:

Payment Methods Costs

- Credit card payments: Most credit card companies charge a percentage fee per transaction as well as a fixed transaction fee. These can range from 1.5% to 3.5% plus a fixed fee of €0.30, for example.

- PayPal: As mentioned in your post, PayPal is a widely used service, but not necessarily the least expensive. PayPal fees vary, but are typically around 1.9% to 2.9% per transaction plus a fixed fee.

- Klarna fees: Klarna offers different fee models depending on the payment method used, such as installment, instant transfer, etc. Fees can range from a fixed amount per transaction to percentage fees.

- Mollie: Mollie does not charge monthly fees and there are no setup fees, which makes it attractive for small to medium-sized businesses. Mollie charges 1.5% €0.25 per successful transaction in Germany. For other payment methods and countries, fees may vary.

- Stripe: Stripe has a relatively transparent fee approach, which usually includes a fixed transaction fee and a percentage of the transaction volume. European cards usually incur fees of 1.4 percent €0.25 per transaction.

- Direct debit: The majority of fees for direct debits are lower than those for credit card and PayPal payments. However, there are payment providers that charge fees for processing direct debits. However, these are usually very low and can also include monthly flat rates.

- Prepayment: prepayment is the cheapest option as there are usually no fees involved. However, there is the downside that this method can discourage customers as it carries the risk of non-delivery.

- Amazon Pay: Merchants usually incur transaction fees based on transaction volume.

- Google Pay: No direct fees to the merchant, but standard credit card fees apply.

- Apple Pay: Similar to Google Pay, no direct fees, but credit card fees apply.

- Alipay: Higher fees may apply for international transactions; a detailed overview should be obtained from Alipay itself.

Store systems

- WooCommerce: As an open-source platform, there are no basic fees, but plugins and extensions may be chargeable.

- Shopify: Monthly subscription fees and possibly additional costs for certain payment providers.

- Shopware: The community version is free, but support and advanced features are chargeable.

- Magento: The open-source version is free, while the enterprise version can incur significant costs.

Profitability calculation

For a holistic assessment of profitability, it is advisable to perform a cost-benefit analysis. Consider not only direct fees, but also indirect costs, such as time and labor required to integrate and maintain the systems.

Conclusion

The choice of payments and store system should be made carefully, considering all fees incurred and long-term profitability. It makes sense to include the specific needs of the online store and the expectations of the target audience in the decision-making process.

How do you plan to regularly review the profitability of your payment methods and store systems? Which KPIs might be relevant for this review?

Online store integration: WooCommerce, Shopify, Shopware, and Magento

The selection and integration of payment solutions is crucial to the success of an online store. Here’s an overview of four popular store systems and their specifics when it comes to integrating payment methods.

WooCommerce

WooCommerce, a plugin for WordPress, is mainly suitable for small to medium-sized businesses. Adding payment options is mostly straightforward and enabled by additional plugins.

Shopify

Shopify is an all-in-one e-commerce solution that is known for its ease of use. The platform seamlessly integrates most major payment options. The system often takes care of transaction processing and security itself, which minimizes the workload for the store owner. Shopify and Brevo make a great team, by the way.

Shopware

Shopware is aimed at medium to large businesses and offers a lot of flexibility, but also a higher level of technical expertise for setup. Payment methods like Amazon Pay, Google Pay, Apple Pay, and Alipay can be integrated, but often only through specialized extensions.

Magento

Magento is a powerful platform that is particularly suitable for large, complex online stores. Payment method integration is highly customizable, but requires a solid technical understanding.

Get customer feedback

Collecting customer feedback is an essential practice for any online store to continuously improve and adapt to the needs of the target audience. Here are some best practices to efficiently collect qualitative and quantitative feedback:

Ask specifically what payment methods your customers miss and use this information to improve your service.

Online surveys

Online surveys can be sent directly on the website or via email. They are particularly suitable for comprehensive data collection and can be customized to evaluate specific aspects of the shopping experience.

Rating systems

Provide your customers with an easy and intuitive way to rate products and services directly on the product page. This not only promotes transparency, but also provides valuable insights into customer preferences.

Live chat

A live chat provides a direct line of communication to customers and can provide valuable real-time information. By collecting feedback during the interaction, issues can be identified and addressed immediately.

Social media

Social media platforms provide an excellent opportunity to take the pulse of customers. Monitor mentions of your online store, and proactively respond to comments and questions.

Customer interviews

For deeper insights, conduct in-person or phone interviews with a selection of customers. This method allows you to ask specific questions and provides room for qualitative responses.

Strategic questions for further reflection

If you are an online store owner thinking about implementing or optimizing payment methods, here are some strategic questions that can help you develop a comprehensive approach to your decision making:

- Target audience analysis: what payment does your target audience prefer? Do these preferences vary by age, location, or other demographic characteristics?

- International expansion: Do you plan to offer your online store in other countries? If so, which payment options are most popular in those markets?

- Cost-benefit analysis: What fees are associated with different payment methods and how do they affect your profitability?

- Security concerns: what security measures need to be considered when implementing certain payment methods, and what risk management is required?

- User experience: how easy is it for customers to use the different payment methods? Could the introduction of new payment methods positively impact conversion rates?

- Legal Aspects: Are there any legal requirements you need to consider when introducing certain payment methods, such as privacy policies or country-specific laws?

- Scalability: Are the payment methods you’re considering scalable if your business grows or needs change?

- Abandonment rates: Could implementing additional payment methods reduce the abandonment rate in the checkout process?

- Customer retention: What payment methods could help keep consumers coming back? In particular, do subscriptions or loyalty programs offer additional opportunities?

- Trends and innovations: What new payment technologies or trends might become relevant in the future? How might you integrate these into your strategy early on?

These questions should serve as a starting point for a thorough review and strategic planning. The answers can provide you with valuable insights into how to best design your payment system to increase customer satisfaction and, ultimately, your revenue.

By the way, you can use the same payment providers for your online course and your WordPress LMS.

Who should read this article?

This article is primarily aimed at online store operators or those considering starting their own store. However, marketers and web developers who want to expand their knowledge of payment methods in e-commerce will also benefit from the information provided here.

Furthermore, the content is relevant for freelancers and agencies who want to advise their clients on the selection of suitable payment methods. If you’re looking for a detailed overview of the most popular payment options and want to understand how they can affect conversion rates and customer satisfaction, this article is for you.

Have you ever thought about implementing new payment methods in your store? What strategies could help you best tailor your payment method selection to your target audience?

FAQs:

Payment Methods Summary

Choosing the right payment methods for your online store is more than just a technical decision; it can have a significant impact on customer satisfaction, conversion rate, and profitability.

Through careful audience analysis, attention to legal frameworks, and a cost-benefit consideration, you can develop a payment strategy that supports both short-term and long-term goals.

Answering the strategic questions listed will provide you with a comprehensive framework for decision-making and allow you to proactively respond to market changes and customer needs.